tax abatement nyc meaning

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. Typically the goal of these programs is to encourage development or renovation of residential properties in specific areas of the city.

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Top Tax Defenders breaks down the purpose of the eligibility for and precautions with tax abatements.

. A co-op tax abatement assessment allows a co-op to raise additional revenue for ongoing building operations and capital improvements by capturing tax abatement or tax exemption proceeds paid to the co-op corporation by the city of New York instead of returning this money to shareholders. Co-Op and condo unit owners may be eligible for a property tax abatement. New york state has passed just such a change.

What is a property tax abatement vs exemption in NYC. Everybody still with. Abatements reduce your taxes after theyve been calculated by applying dollar credits to the amount of taxes owed.

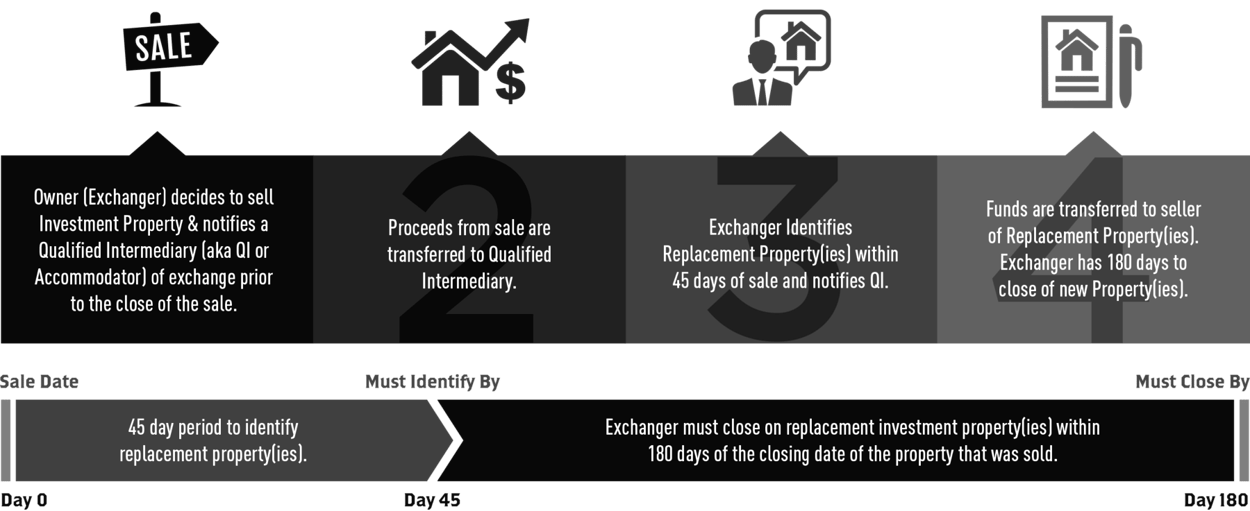

September 14 2021. A tax abatement is a financial incentive that reduces the amount of taxes that an owner pays easing their annual costs and increasing the likelihood of a successful home sale. It is divided into annual 5 installments over a four year cycle not to exceed any one years property tax liability.

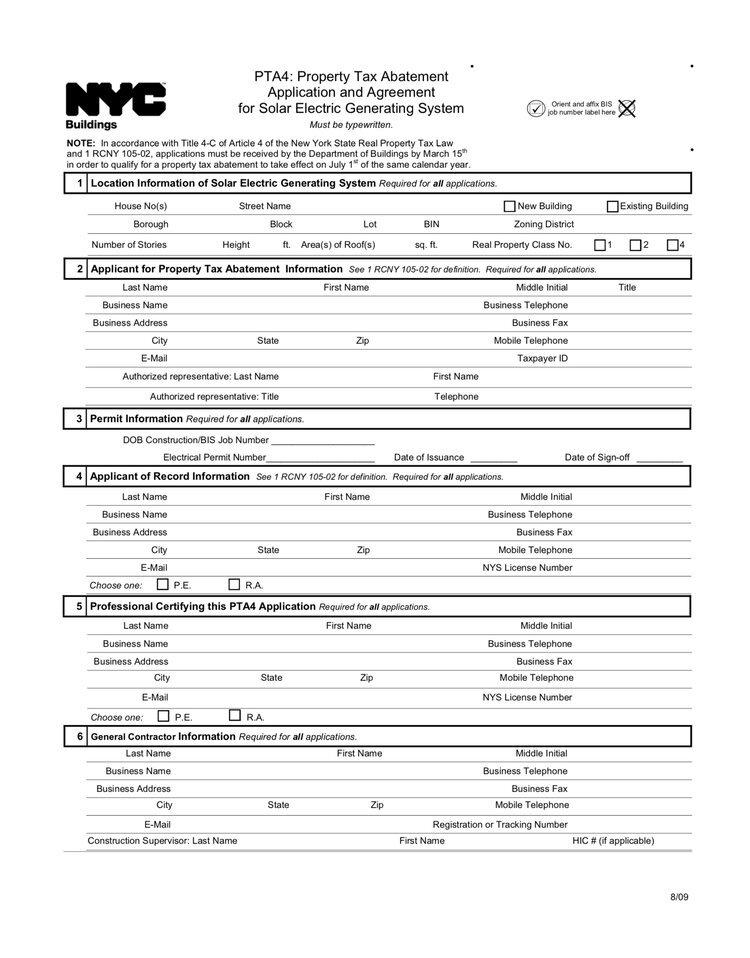

An abatement is usually requested by property owners who feel that the tax assessment is too high given the current value of the property or the owners ability to pay. In short a tax abatement is when the government grants a reduction or exemption from taxes for a specific period in order to stimulate real estate or industrial development. The NYC Property Tax Abatement for solar allows NYC homeowners to claim 20 of solar system costs as a property tax abatement with the NYC Department of Finance.

New York City has several tax abatement programs which can save you thousands of dollars a year and increase your net operating income. As of August 2020 the NYC PTA has been extended for projects installed through 2023. In New York State a 421a Tax Abatement is a tax exemption for real estate developers who build multi-family residential buildings in New York City.

This is a tax incentive program which abates property taxes on a sliding scale typically over a ten year period. Abatement percentages are as follows. However during the 70s there was a spike of Condo and Co-op conversions in New York.

Typically the goal of these programs is to encourage development or renovation of residential properties in specific areas of the city. Benefits vary based on. Originally passed in 1997 and in effect since 2000 the philadelphia tax abatement program was originally conceived to encourage new development affordability and vitalization in the city.

If youre shopping around for a co-op or condo in NYC youre bound to encounter some real estate jargon in listings. One of those perplexing terms is 421a tax abatement. The abatement proceeding pursuant to an owners appeal of an assessment is in the nature of an administrative hearing that either grants the requested relief or upholds the assessment.

The state of New York passed a bill that allows property owners to save on their taxes if they build a green roof on their building. This implies that buyers of the apartment enjoy the benefits of the program. Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

NY Green Roof Tax Abatemnt. PILOT Payment In Lieu Of Tax incentive programs are agreements between COMIDA and a qualified company to make tax payments at a reduced rate over time. The J-51 Tax abatement was initially enacted to grant benefits to owners of rental buildings.

A residential tax abatement program is a reduction of a real property tax bill imposed on specific properties by a local government like New York City. Requirements for affordable housing. The amount of the abatement is based on the average assessed value of the residential units in the development.

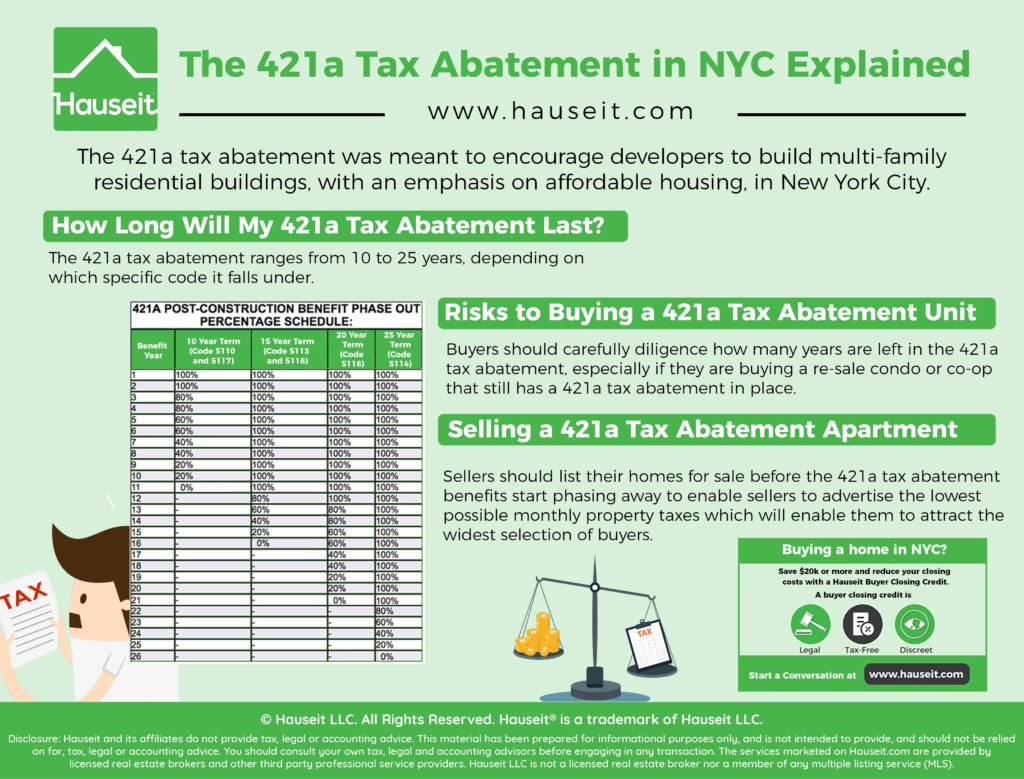

Tax Abatement Buildings in NYC. The tax abatement was meant to encourage developers to build multi-family residential buildings with an emphasis on affordable housing in New York City. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

The original 421a tax abatement program began in 1971 and is named after section 421-a of the New York Property Tax Law. The essence was to encourage them to upgrade their properties. The exemption also applies to buildings that add new residential units.

Building management boards of directors or other official representatives must apply for the co-op or condo abatement on behalf of the eligible building units. Of course in practice its a little more complicated than that. A residential tax abatement program is a reduction of a real property tax bill imposed on specific properties by a local government like New York City.

For one there are many different types of abatements given to buildings for different reasons. IRS Definition of IRS Penalty Abatement. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

Thomas New Yorks cooperative and condominium property tax abatement was signed by the Governor with changes to the definition of qualified property and wage requirements for building service employees. What nycs new tax abatement program means for attorneys. Perhaps the most well-known is the 421a abatement which recently.

The agreement details how the local government will reduce property taxes for an improvement an individual performs to a home or development a company contributes to the local economy. Co-op and Condos Alert. In essence its a tax exemption program given to building developers that typically lowers the property taxes for residential units for some time.

These tax abatement agreements also include a prescribed start and end period lasting usually for 5 10 15 and 25 years. Abatement percentages are as follows. What Is The 421a Tax Abatement NYC.

One wonderful way to maximize your New York City real estate investment is to take advantage of tax programs which reduce the carrying cost of a property for a set period of time. There are multiple variations of the 421a tax abatement ranging from terms of 10 to 25. A break on a building or apartments property taxes.

Put simply a tax abatement is exactly what it sounds like. Abatements can last anywhere from just a few months to multiple years at a time. Your property may qualify for a property tax exemption if your property value changed because you did construction on a multi-family residential building.

This applies to both new buildings and retrofitting existing buildings. One PILOT program COMIDA offers is the JobsPlus program. What Is Tax Abatement Nyc.

More from HR Block. Penalty abatement removal is available for certain penalties under certain circumstances. Owners of cooperative units and condominiums who meet the requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced.

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is A 421a Tax Abatement In Nyc Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

What Is A Tax Abatement Should You Buy A Home With One Localize

The Difference Between Tax Abatements And Tax Exemptions Propertyshark Real Estate Blog

Sell Apartment Online Hauseit Sale House Apartments For Sale Apartment

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is A Tax Abatement Should You Buy A Home With One Localize

What Is The 421g Tax Abatement In Nyc Hauseit

The 421a Tax Abatement In Nyc Explained Hauseit

New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

The Real Reasons Your Home Is Not Selling Buying A Condo Reasons Building Management

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo